For businesses in Singapore, filing Estimated Chargeable Income (ECI) goes beyond a routine administrative duty. Instead, it presents an opportunity to showcase your dedication to transparency, accountability, and strategic tax planning.

The Estimated Chargeable Income (ECI) is an approximation of your company’s taxable profits for a particular Year of Assessment (YA). It is the amount obtained by subtracting tax-allowable expenses from the anticipated taxable income for the financial year.

Whether you’re navigating the early stages of a promising startup or managing an established company, this guide offers a thorough insight into the ECI.

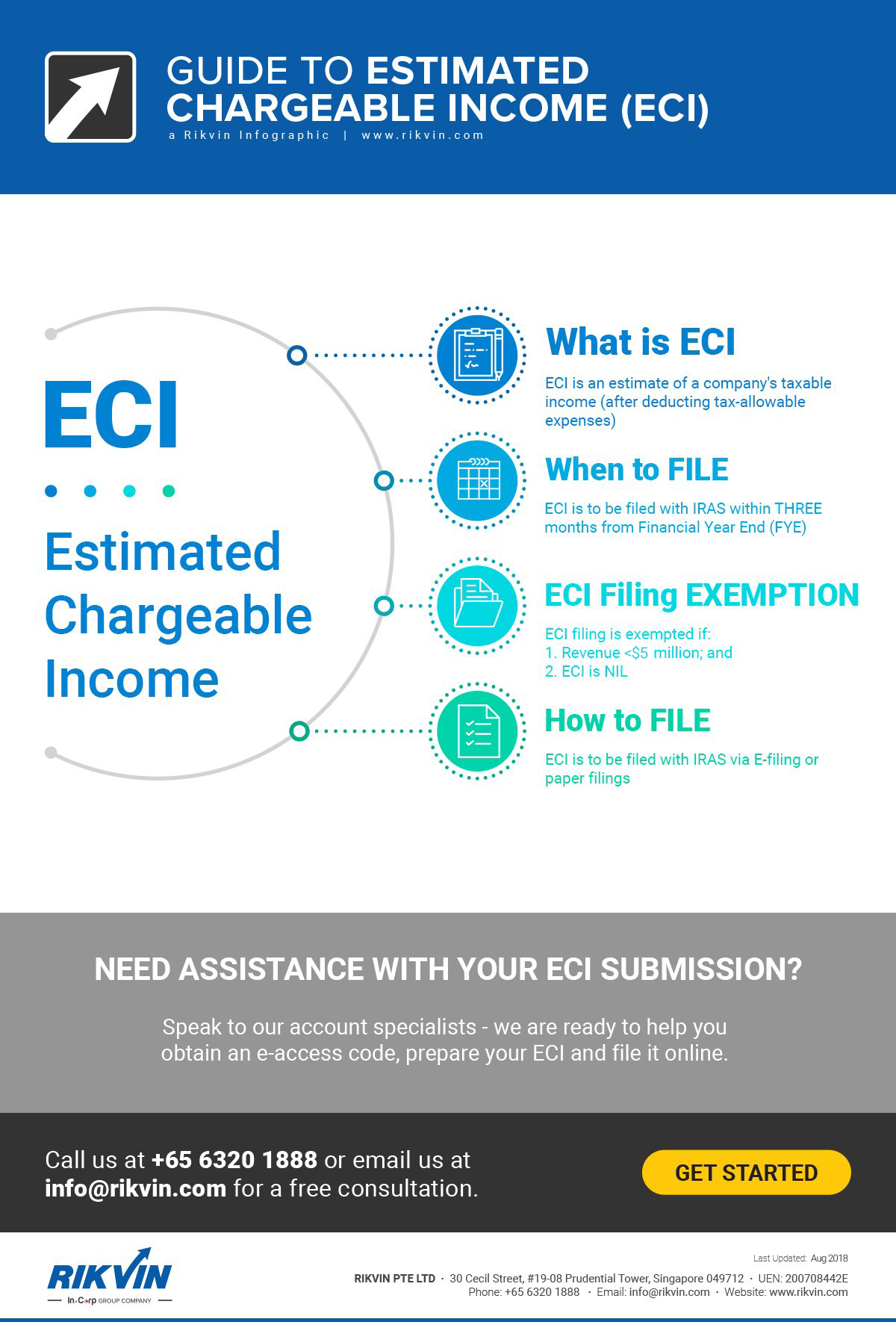

Get an overview of what Estimated Chargeable Income (ECI) is, when to file it, how to file it, and the ECI exemption criteria in the infographic below:

Rikvin’s content team includes in-house and freelance writers across the globe who contribute informative and trending articles to guide aspiring entrepreneurs in taking their business to the next level in Asia.