In Singapore’s bid to further boost the island nation’s reputation as a trusted international financial and business centre, the enhanced regulatory framework for corporate service providers (“CSPs”) will take effect from 15 May 2015. This is part of a larger, global initiative for regulators and governments to crack down on the use of CSPs for illicit purposes such as money laundering and even financing of terrorism.

What does this new global context mean for CSPs and their customers? We take a look at the potential implications and impacts that the new framework will have on the industry.

Understanding the Enhanced Regulatory Framework

The new enhanced regulatory framework centers its focus on two goals, namely:-

- To ensure that CSPs have in place established processes to safeguard against money laundering and terrorism financing

- To raise the professional standards of the industry as a whole

In line with its goals, the Accounting and Corporate Regulatory (“ACRA”) has set up the CSP Enforcement and Regulation Department (“CERD”) in November 2013, to oversee the administration of the new regime and regulate the CSPs. The CERD’s regulatory role will comprise:-

- Processing of applications for registration and renewals by CSPs

- Monitoring compliance by CSPs

- Investigation of breaches by CSPs

- Imposition of applicable sanctions on CSPs

In addition, much like how the Consumers Association of Singapore (“CASE”) functions, members of the public will be able to submit their complaints with regard to the conduct of their CSP. This is in line with the overall aim of raising the professional standards of the industry, as well as offering consumers more protection and to safeguard their interests. However, it should be noted that CERD will only accept complaints specific to compliance with the statutory terms and conditions as set out in the ACRA (Amendment) Act 2014 and the ACRA (Filing Agents and Qualified Individuals) Regulations 2015. Hence, complaints over disputes over professional fees charged by CSPs will not be addressed by the CERD.

What does this mean for my company?

Depending on how rigorous your CSP has been in safeguarding against money laundering and terrorism financing, there will be different implications for your company. More often than not, a CSP will typically conduct its review pre-incorporation; and these are some questions that your CSP may have asked:-

- Full Name, NRIC or Passport number, Residential Address and Nationality of individual client

- Proposed business entity’s information, including its business activities

- Declaration that client is not a Politically Exposed Person (“PEP”)

- Full Name, NRIC or Passport number, Residential Address and Nationality of the Ultimate Beneficial Owner (“UBO”)

A PEP is an individual who is or has been entrusted with a prominent public function by a government or international organisation, such as a director, diplomat or politician. His or her immediate family members and close associates are also collectively grouped under this category. Due to their position, influence and the tendency for governments to relax their immigration policies for PEPs, PEPs are considered to be in positions that can be ideal for money laundering, terrorism financing and its related activities.

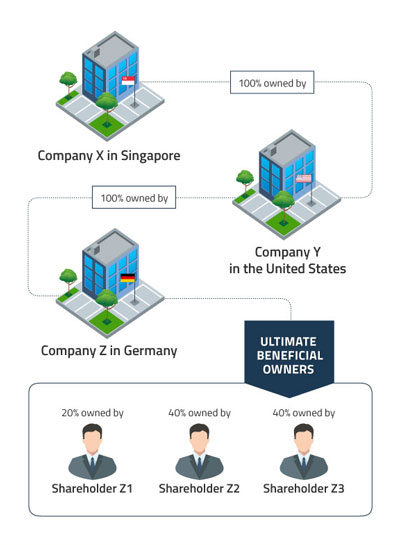

The UBO will be the individual who ultimately benefits from the company and is not the same as the holding company or parent company. For example, if the company in Singapore is a subsidiary of another company in the United States whose parent company is another company located in Germany, the UBOs will be the shareholders of the company in Germany, as depicted in the graphic below:-

Hence, the information that your CSP will require will be that of shareholders Z1, Z2 and Z3.

If your CSP has not asked you for such questions or documentation before, your CSP may take the opportunity to do so in the short term. Companies can then prepare themselves by gathering the following information of their UBOs

- Full Name, NRIC or Passport number, Residential Address and Nationality of the immediate shareholders

- For corporate shareholders, this can come in the form of a Certificate of Incumbency

- Full Name, NRIC or Passport number, Residential Address and Nationality of the Ultimate Beneficial Owner (“UBO”)

Companies that have not been asked such questions or documentation by their CSPs should be particularly concerned, as it means that their CSP is potentially more vulnerable to instances of money laundering and terrorism financing. This in turn means that the CSP could be sanctioned by CERD under the new regulations and may potentially have its license revoked. Eventually, the company will suffer, particularly since it will need to scramble to find a new CSP. This can directly have an impact on the company’s ability to execute corporate actions, or comply with the ongoing statutory compliance regulations.

To learn more and understand how important and essential a CSP is to your company, read more here.

I am currently a CSP provider. What does this mean for me?

If your company is an existing CSP provider, it should immediately begin reassessing the effectiveness of its internal policies, procedures and controls that are in place to mitigate the risk of being an unintentional party to money laundering and terrorism financing activities. Examples of such policies, procedures and controls that CSPs should put in place are:-

- Ensuring that regular contact has be made with the client (i.e. client has not “disappeared” or is uncontactable)

- Obtaining the NRIC or Passport copy of the individual client or its directors or shareholders

- Proper screening and training of employees to ensure that they are aware of the risks of money laundering and terrorism financing activities, as well as the tell-tale signs of a client who may potentially be engaging in such activities

- Conducting customer due diligence on a regular basis, particularly when there has been a change of directors or shareholders of the company

- Simple Google searches to check if existing clients or directors or shareholders are PEPs

- Appoint an employee who also has a management role as the CSP’s compliance officer

- Internal audits to ensure that its internal policies, procedures and controls are effective

Given that ACRA has announced that it will begin its audits of CSPs in November 2015, CSPs should remain complacent even if their client base is small, given that non-compliance could mean that the CERD could impose sanctions, which may result in the unfortunate consequence of a CSP losing its license to access ACRA’s online filing system, Bizfile.

With the exception of Group secretaries (i.e. those whose filing services are specifically only performed for a holding company and its group of subsidiaries) and officers of the company, all CSPs will be required apply to become a Filing Agent (“FA”) and/or Qualified Individual (“QI”). As mentioned above, these applications will be regulated by CERD.

Who would fall under the category of a Filing Agent?

The determination of who would fall under the category of a FA would be dependent on the type of activities being conducted. Generally, if a company or individual provides these services to other companies and individuals for a fee, they would need to apply to be a FA:-

The determination of who would fall under the category of a FA would be dependent on the type of activities being conducted. Generally, if a company or individual provides these services to other companies and individuals for a fee, they would need to apply to be a FA:-

- Incorporation of companies

- Provision of nominee director services, partner for partnerships, or any other related similar services

- Provision of registered office, business address, correspondence or administrative address or related services

- Provision of nominee shareholder for a customer who is not a corporation listed on the securities exchange

Before the implementation of the new regime, CSPs who provided such services were previously known as Professional Number Holders, who used a Professional Number as an identifier for their internal employees who would file transactions using ACRA’s e-portal.

As part of the application to be an FA, one would be required to fulfil all of the following conditions:-

- Is a business entity registered with ACRA

- Employ, engage or appoint at least one QI who is registered with ACRA

- Pay an annual non-refundable application fee of S$200.00 (valid for one year, thereafter, a renewal fee is applicable)

As part of the transition to the new regime, ACRA will be waiving the fee for existing Professional Number Holders up to March 2016 and the transition can be applied for on the Bizfile website. In the interim, existing employees using the Professional Number will continue to enjoy access to the Bizfile website.

Who would fall under the category of a Qualified Individual?

The following individuals would fall under the category of a QI:-

- Advocate and solicitor

- Public accountant registered under the Accountants Act

- Member of the Institute of Singapore Chartered Accountants

- Member of the Association of International Accountants (Singapore Branch)

- Member of the Institute of Company Accountants, Singapore

- Member of the Singapore Association of the Institute of Chartered Secretaries and Administrators

- A Corporate Secretarial Agent

QIs will also be required to pay an annual non-refundable application fee of S$100.00 (valid for one year, thereafter, a renewal fee is applicable). Similar to that of FAs, ACRA will be waiving the fee during the transition exercise for those who are currently classified as “Prescribed Persons”, which would follow the same definition as that above. However, the renewal fee will not be waived.

The above examples of the enhanced regulatory framework and increasing obligations on CSPs reflect an increasingly aggressive global regulatory environment – one that requires all stakeholders to keep pace, both in Singapore and around the world.

Interested in our corporate services?

As a one-stop corporate solutions provider, Rikvin has consistently helped small and medium sized enterprises, start-ups and companies like you remain in compliance with authorities as well as avoid unnecessary penalties or losses.

Rikvin’s content team includes in-house and freelance writers across the globe who contribute informative and trending articles to guide aspiring entrepreneurs in taking their business to the next level in Asia.