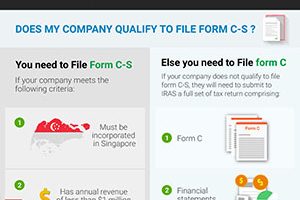

This article address two main questions pertaining to Corporate Income Tax Filing for Singapore companies: What are the two options Singapore

Corporate Tax

Guide to e-Filing of Corporate Income Tax Returns Forms C-S and C

Get Started NowForm C-S/C-S (Lite) is an abridged 3-page Income Tax Returns form for eligible small companies to report their income to IRAS. Form

Criteria for Audit Exemption for Small Companies

Since 1 July 2015, small companies have become eligible for audit exemption under certain conditions Criteria for audit exemption for small companies

Need help with your unaudited report?

We are experts when it comes to Singapore's company laws and regulations. With Rikvin, preparation of your company's unaudited report is done right and in compliance with all statutory requirements.

What to Do If You Miss the Tax Filing Deadline

Get Started NowFiling of audited or un-audited accounts as well as tax planning is very important. The Inland Revenue Authority of Singapore (IRAS)

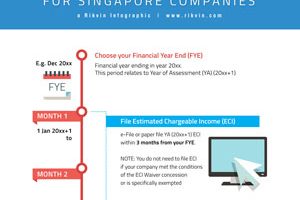

Corporate Income Tax Filing for Singapore Companies

Contact UsWhether you are an individual or a corporate entity, knowing when to file your taxes will be essential, particularly if you want to avoid

Need help with corporate tax filing?

Our taxation specialists can help you! Call us at +65 6990 8220 or contact us now for a free consultation.

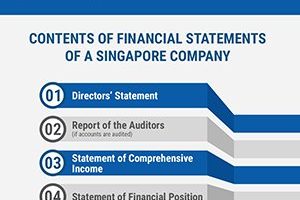

Contents of Financial Statements of a Singapore Company

Financial statements are detailed reports offering a transparent summary of a company's financial performance and position within a specific period.