Singapore is widely regarded as one of the world’s most expensive cities to live in. As a result, financial management is a critical component of surviving and thriving in Singapore for both citizens and permanent residents.

It is a common misconception that only high-net-worth individuals should engage in tax planning; however, individuals in the middle class can also save significantly with good financial management and a good tax strategy.

Read on to find out some of our tips and tricks for personal tax saving in Singapore.

Table of Contents

Take Advantage of Various Personal Tax Reliefs

If you live in Singapore as a citizen or as a tax resident, you are eligible for a number of personal benefits.

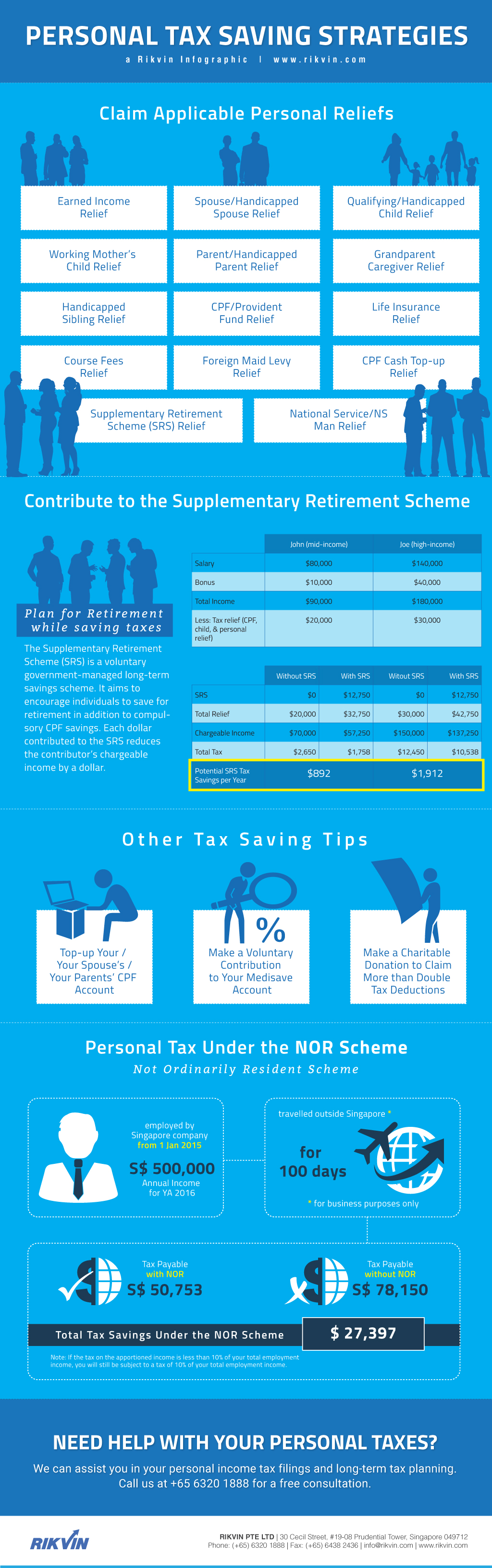

Personal income tax reliefs which are applicable to all taxpayers in Singapore include:

- Course Fees Relief

- CPF Cash Top-Up Relief*

- CPF Relief*

- Earned Income Relief

- Handicapped Brother/ Sister Relief

- Life Insurance Relief

- NSman (Self) Relief

- Parent/ Handicapped Parent Relief (For maintenance of parents, grandparents & great-grandparents, including in-laws)

- Supplementary Retirement Scheme (SRS) Relief

Additional Personal Income Tax Reliefs Available to Selected Taxpayers include:

- NSman (Parent) Relief

- Qualifying/ Handicapped Child Relief

- Spouse/ Handicapped Spouse Relief

- Foreign Domestic Worker Levy Relief

- Grandparent Caregiver Relief

- NSman (Wife) Relief

- Working Mother’s Child Relief

To determine which personal income tax reliefs you’re eligible for, you may use this Personal Relief Checker.

Make a contribution to the Supplementary Retirement Scheme

What is the Supplementary Retirement Scheme (SRS)?

The Supplementary Retirement Scheme (SRS) is a voluntary scheme designed to encourage individuals to save for retirement in addition to their CPF contributions. Contributions to SRS are tax deductible.

How does the SRS help save?

Every dollar that you contribute to this scheme reduces your chargeable income by a dollar. Therefore, your SRS contribution will be equal to the tax relief amount that you can claim.

The maximum yearly contribution to SRS is

- $15,300 for Singaporeans and Permanent Residents and

- $35,700 for Foreigners

Therefore, without SRS, your taxable income would be your employment income minus your personal reliefs. With SRS, your taxable income would be even lower as it would take into consideration your SRS contributions.

Refer to our infographic for a numerical illustration of how much you could save in taxes with SRS.

Top-up your CPF

You are eligible for tax relief if you or your employer tops up your CPF savings.

You can benefit from tax relief of up to $16,000 for cash top-ups made in each calendar year. You can claim up to $8,000 in tax relief when you make top-ups for your own retirement savings.

If you top up your CPF account for your Special Account, the amount will be deducted from your chargeable income up to S$8,000.

You can save another $8,000 by contributing to your parents’ or grandparents’ CPF SA/RA. This applies only up to the current Full Retirement Sum ($198,800 in 2023); anything above that does not qualify for tax relief.

Contribute to your Medisave Account

In addition to the mandatory contributions made to your Medisave account, voluntary top-ups are an option. You can top up your Medisave to the Basic Healthcare Sum (currently $68,500 in 2023) in the same way that you can top up your CPF.

Your funds, like the CPF Special Account (SA) balance, will be locked up, but you can use them for medical expenses and health insurance premiums.

Make a Charitable Donation

Any donations and contributions that are made to a Qualifying Grant-making Philanthropic Organization of an Institution of Public Character (IPC) are tax-deductible. Your taxable income will be reduced by $2.50 for every $1 donated to an approved IPC.

The amount of the donation is not required to be reported on your tax return. Based on the information from the IPC, tax deductions for qualifying donations will be automatically reflected in your tax assessments.

Please keep in mind that IRAS will no longer accept tax deduction claims based on donation receipts; only cash donations made to an approved Institution of a Public Character (IPC) or the Singapore Government for causes benefiting the local community are tax deductible.

Personal Tax under the Not Ordinarily Resident Scheme

If you meet the criteria for the Not Ordinarily Resident (NOR) scheme, you will receive preferential tax treatment for the first five years of your assessment (YA).

Regrettably, the NOR scheme has since been discontinued. The most recent NOR status granted will be valid from YA 2020 to YA 2024. Individuals who have qualified for NOR status will continue to benefit from NOR tax breaks until their NOR status expires, assuming they continue to meet the concessions’ conditions.

For a condensed version of our tips on how to reduce your income tax liabilities as a Singapore tax resident, see the infographic below.

Click here to read more about how you can reduce your personal taxes.

Contact Us In this infographic, we highlight some simple tips to reduce your income tax liabilities as a Singapore tax resident. Learn about the different personal reliefs available, how to plan for retirement while saving taxes, as well as tax concessions for jet-setting expats under the Not Ordinarily Resident scheme. For further reading, please check out: A Personal Income Tax Guide for Foreigners in Singapore.

Reduce your personal income tax

Allow us to take care of the work for you. Rikvin ensures that your taxes are filed correctly and well before the deadline.

Rikvin’s content team includes in-house and freelance writers across the globe who contribute informative and trending articles to guide aspiring entrepreneurs in taking their business to the next level in Asia.