Singapore is home to a substantial Indian diaspora, making it quite logical that numerous Indian enterprises have chosen to establish their operations in the city-state. As per the Indian High Commission in Singapore, there are approximately 9,000 registered Indian companies in Singapore.

Prominent Indian corporations, including Tata Group, Mahindra & Mahindra, Reliance Industries, AdGroup, Infosys, and Wipro, have established their presence in Singapore. The trade relationship between India and Singapore has thrived over many years, displaying strength and resilience.

Since 2014, India has been successful in attracting an increasing number of manufacturers to its shores, largely thanks to the “Make in India” campaign initiated by Prime Minister Narendra Modi. This campaign was aimed at elevating India’s global manufacturing prominence, facilitating the influx of new technology and capital, and generating millions of job opportunities.

In pursuit of these goals, the government has taken steps to simplify the operating environment for foreign companies within the country. As evidence of these efforts, India climbed from the 130th position to the 63rd position among 190 countries in the World Bank’s Ease of Doing Business Index between 2016 and 2019.

India’s future target is to further augment the manufacturing sector’s contribution to the gross domestic product (GDP), with a goal of reaching 25% by 2025, an increase from the current 16%.

The Indian Government’s Department for Promotion of Industry and Internal Trade (DPIIT) – the nodal agency for the campaign – has approved a three to six month time frame for various government ministries and departments to implement a slew of regulatory reforms aimed at making India an attractive investment destination. These might include reducing the time for registering a business from 27 days to one day, single registration for all labour laws and an overhaul of tax systems.

As of now, India ranks 134 in the World Bank’s index, behind China (96th rank), Pakistan (110) and Bangladesh (130).

While the Indian Government’s intentions are obviously praiseworthy, it will do well to learn from the Singapore experience. Notably, Singapore has consistently ranked at the top of Ease of Doing Business index year-after-year. Thus, till such time India cut-short its infamous red-tapism, foreign entrepreneurs and companies are well-advised to use Singapore as the launchpad for their Indian businesses.

With no capital gains tax, and one of the lowest corporate tax rates in the world, the time taken to incorporate a business entity in Singapore is just a few hours if all the paperwork is in order. Add to it, 75 comprehensive double taxation agreements and 8 limited treaties dealing with income from shipping and air transport enterprises, as well as no controlled foreign company rules, the city-state is easily the most preferred destination for company incorporation in Asia by a long distance.

While Singapore provides the most ideal incorporation choice for foreign companies looking to expand in India, it also helps foreign entrepreneurs tap into Asia’s other emerging markets.

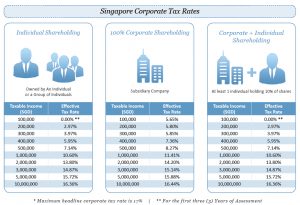

Corporate Tax Rates in Singapore

Singapore tax resident companies are taxed on profits derived in Singapore, as well as on foreign soil, which are then remitted to Singapore.

The corporate income tax, which is calculated on the basis of the company’s chargeable income, i.e. taxable revenues less allowable expenses and other allowances, has its rate fixed at 17% since 2010.

The headline corporate tax rate in India is 30%, excluding surcharge and education cess.

Global Tax Calculator

To compare Singapore’s corporate tax rate vis-a-vis that of India and other major jurisdictions, use our free global tax calculator.

Corporate Income Tax (CIT) Rebate

There is also the CIT rebate announced in 2013 for year of assessment 2013, 2014 and 2015.

There is also the CIT rebate announced in 2013 for year of assessment 2013, 2014 and 2015.

All companies are granted a 30 percent corporate income tax rebate subject to an annual cap of S$30,000, for these three years.

Tax Exemption under the Start-up Tax Exemption (SUTE) scheme

Moreover, the Singapore Government grant tax exemptions under the SUTE scheme, for which the eligibility conditions are:

- not more than 20 individual shareholders

- if there are corporate shareholders, one individual must hold at least 10 percent of the issued shares

- property and investment holding companies are not eligible

If the above three conditions are satisfied, tax exemption is given to start-ups on normal chargeable income of up to S$300,000 for each of the first three consecutive years of its operation

- for the first S$100,000, after 100% exemption, the exempt amount is S$100,000

- for next S$200,000, after 50% exemption, the exempt amount is S$100,000

- thus, the total exempt amount for income up to S$300,000 is S$200,000

No Tax on Dividends

As Singapore has a one-tier corporate tax system, corporate profits are taxed at the corporate level, which is the final tax paid. Thus, dividends distributed by Singapore tax-resident companies are tax-exempt in the hands of their shareholders in Singapore. Additionally, Singapore does not impose any withholding tax on dividends.

No Capital Gains Tax

Another benefit of a Singapore holding company is that the country doesn’t have a capital gains tax regime. Income tax is only imposed on the gain on the disposal of shares/investments if the gain is regarded as a revenue gain sourced in Singapore.

Tax Exemption for India Sourced Income of Singapore Companies

A very important consideration for those who incorporate a Singapore holding company to do business in India are the clauses for tax exemption on foreign-sourced income of Singapore companies. As detailed in Sections 13 (7A) to 13 (11) of the Income Tax Act (ITA) of Singapore, companies can benefit from the foreign-sourced income exemption scheme (FSIE), which applies to:

- Foreign sourced dividend – paid by a non-Singapore tax resident company, which may have been temporarily deposited into a foreign custodian account before its remittance into Singapore

- Foreign branch profits – profits generated by the business operation of a Singapore company registered as a branch in a foreign country

- Foreign-sourced service income – income generated by a resident taxpayer for services provided through a fixed place of operation (office or place of management) in a foreign country

Importantly, the above exemptions apply only when the headline corporate tax rate in the foreign country from which the income is received is at least 15%, and the income has already been subjected to tax in that particular country.

Related Read: India making all the right moves for foreign investment

How to Avoid Double Taxation between India and Singapore

Another factor to consider is avoidance of double taxation between India and Singapore because sometimes India sourced income of a Singapore tax resident company may be subject to taxation twice – once in India, and then in Singapore when the income is remitted here.

Another factor to consider is avoidance of double taxation between India and Singapore because sometimes India sourced income of a Singapore tax resident company may be subject to taxation twice – once in India, and then in Singapore when the income is remitted here.

In such cases, Singapore companies can avail the Foreign Tax Credit (FTC) scheme, which allows the company to claim a credit for the tax paid in India against the Singapore tax that is payable on the same income. The claim is called:

- Double Tax Relief (DTR) – provided for under Singapore-India Avoidance of Double Tax Agreement (DTA)

FTC Pooling System

The government, in 2011, also introduced a FTC pooling system to give businesses greater flexibility in their FTC claims, reduce the taxes payable on foreign income, and to simplify tax compliance. The eligibility conditions were the same as in FSIE i.e. the headline corporate tax rate in the foreign country from which the income is received is at least 15%, and the income had already been subjected to tax in that particular country.

Make-in-India but via a Singapore Company

Thus in summary, while Singapore provides the most ideal incorporation choice for foreign companies looking to expand in India, it also helps foreign entrepreneurs tap into Asia’s other emerging markets such as China, Thailand, and Indonesia.

Thus in summary, while Singapore provides the most ideal incorporation choice for foreign companies looking to expand in India, it also helps foreign entrepreneurs tap into Asia’s other emerging markets such as China, Thailand, and Indonesia.

Related Article: India Singapore DTAA 2017

Incorporate a Singapore Holding Company and establish your gateway to India

A Singapore Holding Company will help you gain access to India’s huge emerging market. Take advantage of the DTAA between India and Singapore to benefit from considerable tax savings for your company.

Rikvin’s content team includes in-house and freelance writers across the globe who contribute informative and trending articles to guide aspiring entrepreneurs in taking their business to the next level in Asia.