Startup Guide for Small or Medium-sized Enterprises

How to Start a Small or Medium-Sized Business in Singapore

In recent times, these enterprises have shot into the limelight because of Singapore’s collective focus on economic restructuring and raising productivity, leading to many SMEs facing challenges in manpower, land and energy.

But, as every cloud has a silver lining, the hard times for Singapore SMEs give a not-too-often-available opportunity for aspiring entrepreneurs to take the plunge and start their own businesses.

The advantage is that while established SMEs, which have traditionally relied heavily on foreign manpower and are thus struggling as the government has tightened the workforce inflow, the newly incorporated business entities can start afresh.

They can put in place highly efficient processes operating at full productivity in their initial set-up, eliminating or at least minimizing their need for foreign manpower. They can also benefit from the many schemes that the Singapore Government has introduced especially targeting the SME sector.

Below is a guide on what all you need to know before setting up an SME in Singapore, and what you need to know once you have decided how to set-up one.

Related Post: Read about some tips that you should consider in your startup.

Considerations before Starting a Small or Medium-sized Business in Singapore

Demarcate a budget and prepare a blue-print

Use all your creativity to gather finances

Firstly, put some of your money in the business. When investors see your confidence, they will be more willing to put their money behind you. Remember no one will back you unless you can vouch for yourself first!

While bank loans may be tough to get, opt for venture capitalists or use platforms such as crowd-funding. These are ideal for small businesses, especially those with some societal undertone or a paradigm-shifting idea.

Prepare to use online marketing strategy

As it’s an internet age and Singapore is a highly connected society, register your domain address on the web and use search engine optimization so as to maximize the traction on your website. It will give you potential business. Here, you have to take a call whether to choose a .sg, .com or any other domain extension, depending on the market you’re targeting. Remember to choose the extension, keeping in mind your business expansion plans and the long-term vision.

When the website is up and running, use all the available social media tools to maximise your reach. Don’t underestimate the power of word-of-mouth marketing strategy.

Physical location does matter

While an online presence has its advantages, it still can’t replace the real thing. So, if you are opting for a retail business (or any other type with potential walk-in customers), it’s all about location, location, location. The idea is to identify your buyers and target audience, which will help in locating the best site for your enterprise.

Put a qualified support team in place

This is important as an attorney, accountant, incorporation specialist, or financial adviser will likely see potential challenges to the business before you do. They also advise you on the several statutory compliance requirements, permits and licenses required to do business in Singapore.

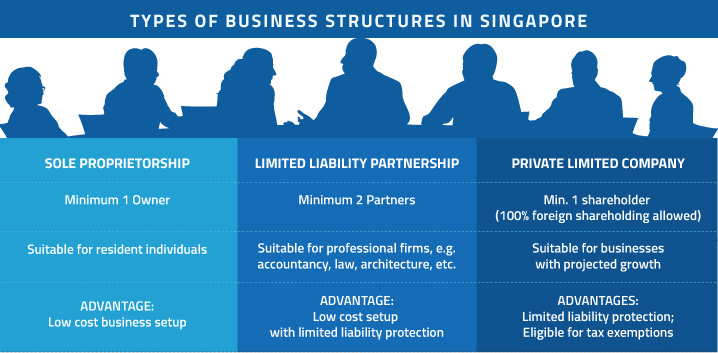

Types of Business Structures for SMEs in Singapore

While there are five options to choose from, namely sole-proprietorship, partnership, limited partnership, limited liability partnership (LLP) and a private limited company; the last one remains the most popular option as it is the most advanced and flexible business entity.

A private limited company is a separate legal entity (and can thus own properties, enter contracts, sue and be sued in its own name), with members having limited liability. Among its types, the most preferred type is an exempt private company, which has no more than 20 shareholders (none among whom are corporate entities). Other options include a private company (with up to 50 shareholders), or a public company limited either by shares or by guarantee.

LLP, which is a perfect blend of a partnership with private limited company set-up, is suited for individuals engaged in professional services such as lawyers, architects and accountants. This type of business entity is easy to set-up, and even easier to administer.

While the requirements for registering each type of business entities differ minutely, a private company registration process requires one local resident director, one shareholder (corporate shareholders are permitted), S$1 or more in paid up capital, a local company secretary, and a local registered address.

Engaging a company registration specialist, which can also provide the local director, local company secretary and local registered address, can aid in incorporating the company with Accounting and Corporate Regulatory Authority (ACRA) in a matter of few hours if all the paper-work is in order.

Incorporating a Sole Proprietorship in Singapore

A sole proprietorship is the simplest type of business entity in Singapore, but it is also the most risky. Thus, it is suitable for small businesses that have negligible or no risks. It is owned by one person who is the decisive authority and owns all the assets and liabilities of the business.

The obvious advantages are:

- easy and inexpensive to set up and strike-off

- easy to administer and manage because of undivided authority and control

- less administrative duties and statutory compliance requirements

Read more: Types of Singapore Business Entities »

Converting a Sole-proprietorship into a Private Limited Company in Singapore

- As a private limited company registered under the Singapore Companies Act has a separate legal existence from its owner; the company shareholders have limited liability. Thus, in comparison, a sole proprietor faces a greater risk of complete personal financial ruin compared to a director of a private limited company.

- Private Limited companies pay corporate tax on their profits. Whereas sole-proprietors are taxed on the personal income tax rates, which are generally higher.

- Sole proprietorships often have limited funding-raising options, whether in terms of getting loans from financial institutions or in terms of equity fundraising from investors. A private limited firm can cast their net wide.

The process of conversion is quite simple:

- First, as the owner of the sole proprietorship, you will need to write a letter stating that you have no objections using the business name as the name of a private limited company.

- Second, incorporate a private limited company using Rikvin’s full suite of business registration services.

- Third, transfer all business assets formally to the newly incorporated private limited company, including the novation of existing contracts of the old business.

- Finally, the sole proprietorship is to be terminated and ACRA is to be informed that you have ceased to carry on business as a sole proprietorship.

More on this: A Guide on Converting Sole Proprietorships into Private Limited Companies »

8 Government Schemes Targeting SMEs in Singapore

As mentioned above, this is the right time for all aspiring entrepreneurs in Singapore to start their business, primarily due to a plethora of available government schemes especially targeting the SME sector. We present an overview of eight such schemes below.

Raising Productivity and Restructuring Processes

1) Innovation and Capability Voucher (ICV)

- be registered and operating in Singapore

- have a minimum of 30 percent local shareholding

- have group annual turnover of not more than $100 million; or group employment size of not more than 200 employees

The government has refined the scope of supportable productivity solutions under the scheme with effect from December this year, and the purchase of website and mobile application development will not be supported henceforth unless they are part of Integrated Solutions.

2) iSPRINT (Increase SME Productivity with Infocomm Adoption & Transformation)

In place since 2010, iSPRINT is aimed at supporting SMEs’ use of technology to boost productivity and growth. The S$500 million ICT for Productivity and Growth (IPG) programme announced in Budget 2014 gives further boost to this effort. With effect from August 2014, IPG is incorporated into iSPRINT (known as Enhanced iSPRINT now), giving enhanced and broadened coverage, while simplifying the application process.

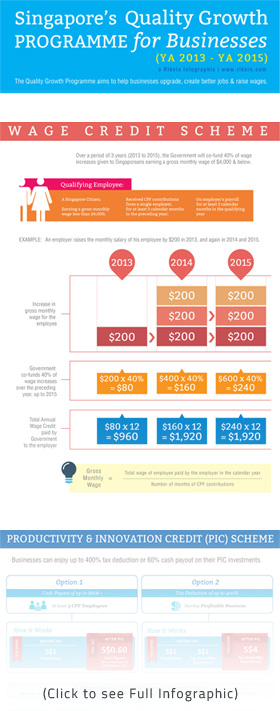

3) Productivity and Innovation Credit (PIC)

SMEs (and all companies registered in Singapore) can enjoy up to 400% tax deductions/ allowances and/or 60% cash payouts for investment in innovation and productivity improvements in any of the six qualifying activities. The tax benefits under PIC are available from years 2011 to 2018. Additionally, from years 2013 to 2015, businesses can also benefit from a PIC Bonus, which is a dollar-for-dollar matching bonus given on top of the existing tax deductions/ allowances and/or the cash payout.

4) Wage Credit Scheme (WCS)

To help SMEs cope up with the rising wage costs in a tight labour market, the Wage Credit Scheme was introduced to allow businesses to make productivity investments and share the productivity gains with their employees. Under the sheme, from YA 2013 to YA 2015, the Singapore Government is co-funding 40 percent of wage increases given to Singaporean employees earning a gross monthly wage of $4,000 and below.

Workforce Training and Support

5) WorkPro

Jointly developed by Singapore’s Ministry of Manpower (MOM) and the Singapore Workforce Development Agency (WDA), WorkPro is aimed at helping employers improve their workplace practices and enhance work-life harmony, as well as attract and retain back-to-work locals and mature workers. The scheme is designed in consultation with Singapore National Employers Federation (SNEF) and the National Trades Union Congress (NTUC), who will manage and administer the programme for three years between April 1, 2013, to March 31, 2016. Under WorkPro, SMEs will receive assistance/incentives to implement work-life measures and flexible work arrangements, redesign jobs, recruit mature workers and back-to-work locals.

6) SME Enhanced Training Support 6

Started in 2012, and running till 2015, the Enhanced Training Support for SMEs is a key mechanism for companies in Singapore to raise productivity by upskilling their employees without affecting the SME’s bottomline. The scheme funds and encourages SMEs to invest in Continuing Education and Training (CET) to maximise their manpower and enhance productivity.

Overseas Support

7) Market Readiness Assistance Grant (MRA)

The MRA is designed to help Singapore SMEs in venturing overseas by working closely with International Enterprise (IE) Singapore’s panel of partners and defraying a portion of the costs in the pre-scoped professional services including market assessment, market entry and business restructuring through internationalisation. IE Singapore co-funds 50 percent of the eligible cost for supportable activities, capped at S$20,000 per company per year, with the maximum project support period not exceeding six months.

Financing

8) Micro Loan Programme (MLP)

The Micro Loan Programme scheme of up to S$100,000 is open for SMEs:

- registered and operating in Singapore

- has 10 or less employees; or has annual sales not exceeding S$1 million

- have a minimum of 30 percent local shareholding

- have group annual turnover of not more than $100 million; or group employment size of not more than 200 employees

This loan is granted at a minimum 5.50 percent interest rate for loan tenure of four years and below, subject to participating financial institutions’ assessments of the risks involved.

Recently, the MLP was enhanced with the Singapore Government increasing the risk-share in the MLP. But companies must be less than three-years-old to be eligible for this enhancement.

Form an SME in Singapore with speed, ease and value

An hour is all we need. Coupled with transparent, highly-competitive pricing and timely, committed support, your SME registration is made easy.